Why trade options instead of just buying shares of stock?

- Leverage – options, out of many other advantages, give you leverage that regular stocks just can’t match.

With one option trade, instead of dropping $5,000 on a stock for 100 shares at $50 each, you might just pay $200 for a call option and still control the same 100 shares.

If the stock goes your way, your percentage gains can be way bigger than simply owning shares. You get exposed to the stock upside for much lower initial investment.

Welcome to the big boys table. - Flexibility – Options offer flexibility for your trading.

You can make money if stocks rise, fall, or even stay flat, depending on how you set up calls and puts.This is the biggest benefit of trading options. - Loss protection – Shielding from the losses, in options terms – hedging, gets easier with options.

Put options act kind of like insurance for your stocks. It’s hard to do that elsewhere.In other types of trading, this is much harder to achieve. If you think about it – if big companies and influential people use this type of “trading”, why wouldn’t you too? - Variety – You’ve got variety in how you play the market.

Options let you trade on volatility, time decay, and price movement all at once—pretty cool, honestly.Like being able to play all positions in basketball, you just have to pick what suits you the best. - More income – For folks looking to earn more from their portfolio of stock positions, options provide income through covered calls and cash secured puts, or protection through buying puts.If this is your first time hearing about these terms, don’t worry – these are just fancy names. Repeat them enough times and you’ll get the hang of it.

Why Do Options Exist?

Options exist because they solve what classic trading can’t: asymmetric risk.

What does that mean?

With leverage or classic trading in general, the good and bad scenarios are symmetrical—you make 5x or lose 5x.

With options, you can make 3x but can only lose 1x.

This is the entire purpose of options.

- You get the upside of leverage without the downside of forced liquidation.

- More control and flexibility

This is appealing and it works if you’re buying options.

What other purpose do options have?

- You can get some additional cashflow (1-5% per month)

- You can generate income a bit more safely

This works if you’re choosing to sell options.

To be clear, you don’t pick a side between buying and selling options and just stick with it – you need to adapt do the situation and the idea you have.

In short, options give people flexibility to protect, profit, or generate income with stocks in ways that aren’t possible by just buying or selling the shares of stocks.

They are an “add-on” to stocks.

Let’s run it back through a different angle

Risk Management is a big reason options came about.

You can protect your investments from big losses.

If you own stocks, you can buy puts to limit how much you might lose.

This is extremely useful when some bad news emerge, usually in other types of trading you would get liquidated or forced out of your investment.

Leverage lets you control more assets with less money.

You can buy an option for way less than the actual stock.

This gives you exposure to price moves without paying full price for the underlying asset.

Big benefit if you’re starting out with a small account or have some spare money left each month to capitalize on some plays.

Income Generation is another big use.

You can sell options and collect premium payments.

Plenty of investors use this to earn extra money from shares they already have.

Imagine owning a stock you believe in long term and also catching some monthly “rent” on it. Pretty useful stuff.

Options offer flexibility that stocks just don’t.

You can profit in almost any market.

Different types of option strategies let you customize your approach.

Market Efficiency improves when options add liquidity.

More trading keeps prices fair.

Hedging protects businesses from wild price swings.

Companies use options to lock in costs for materials, which helps them plan and avoid nasty surprises.

What’s important for you to get out of this text is that there are various advantages.

Want to start trading options?

If you want to get started with options trading, the next step is to know that options have different names of strategies and that they come with:

1) how much time you plan on being in a trade (expiration date)

2) prices that you need to pick (strike price)

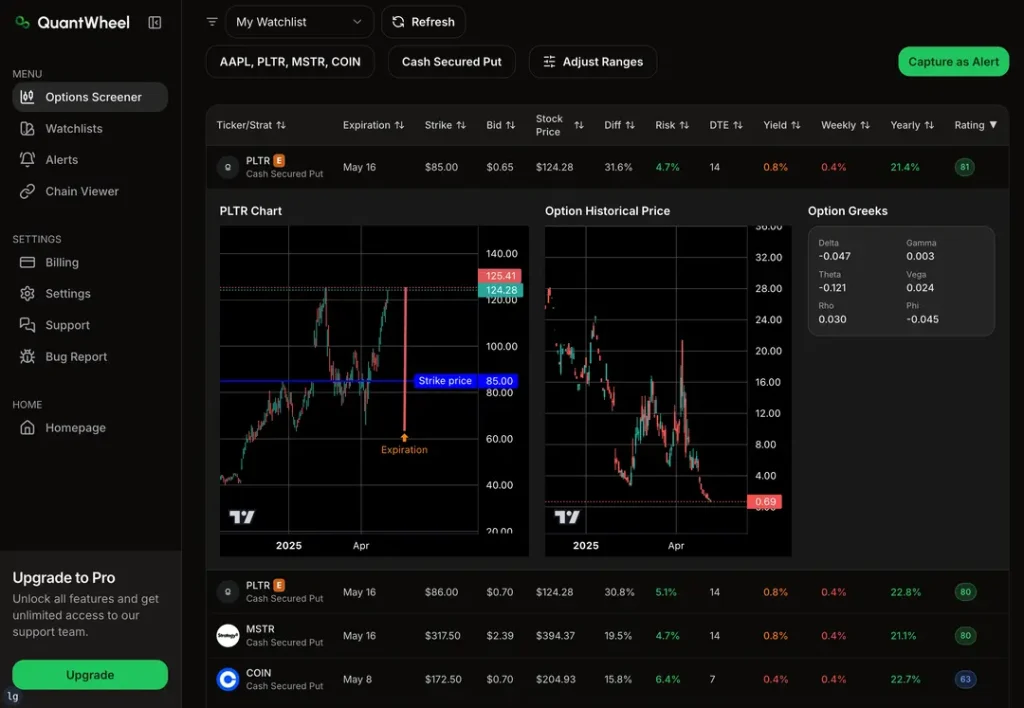

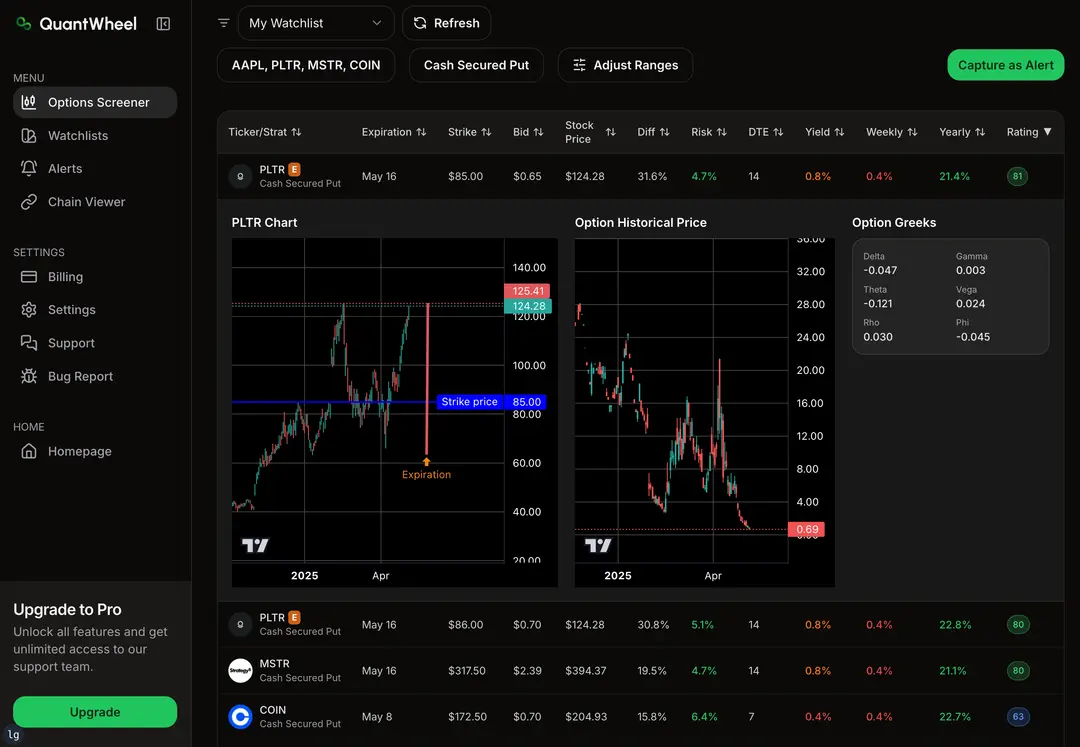

QuantWheel makes this job of trading options easier.

It finds the trades for you and ranks them by a custom rating which traders have used and trusted for the past several years.

This should help you make less mistakes when starting out.

You can jump in and test for yourself here or by clicking on the picture below: