The long ongoing debate: Selling Puts Vs Buying Stocks – what’s better?

When you want to get exposure to a stock, you have two main choices: buy the stock directly or sell put options. Both strategies can help you profit from rising stock prices, but they work very differently.

Selling puts lets you collect premium upfront while potentially buying stocks at a lower price, while buying stocks gives you immediate ownership and unlimited upside potential. Each approach has different risk profiles and profit potential. Your choice depends on your investment goals and risk tolerance.

Understanding these two strategies will help you make better investment decisions. You need to know how each one works, what risks you face, and which situations favor one approach over the other.

Core Differences Between Selling Puts and Buying Stocks

Selling puts involves selling contracts that give buyers the right to sell stocks to you at a set price. Buying stocks means purchasing shares directly to own part of a company.

Definition and Mechanics

When you sell a put option, you receive money upfront from the buyer. You agree to buy 100 shares of stock at the strike price if the buyer decides to sell them to you before expiration.

The put buyer pays you a premium for this contract. They have the right but not the obligation to sell you their shares.

When you buy stocks, you purchase shares directly from the market. You own part of the company immediately. No contracts or expiration dates are involved.

Put Selling Process:

- Receive premium payment

- Wait until expiration or assignment

- May be forced to buy shares at strike price

Stock Buying Process:

- Pay full share price

- Own shares immediately

- Hold as long as desired

Comparison of Risk and Reward

Selling puts limits your profit to the premium you collect. Your maximum gain is fixed when you enter the trade. Your loss potential is large if the stock price drops far below the strike price.

Buying stocks offers unlimited profit potential. The stock price can rise indefinitely over time. Your maximum loss is the full amount you paid for the shares.

Put sellers face assignment risk. You might be forced to buy shares at a higher price than the current market value. This happens when the stock price falls below your strike price.

Stock buyers control when they sell. You choose your exit timing based on your investment goals and market conditions.

Obligations and Rights

As a put seller, you have an obligation to buy shares if assigned. You cannot choose when this happens. The option buyer decides whether to exercise the contract.

You must maintain enough cash in your account to purchase the shares. Your broker requires this margin as security for your obligation.

Stock buyers have full ownership rights. You can sell your shares anytime during market hours. You may receive dividends if the company pays them.

No expiration dates apply to stock ownership. You can hold your shares for years or decades if you choose.

Market Scenarios and When to Use Each

Sell puts when you want to buy a stock at a lower price. You collect premium while waiting to see if you get assigned the shares. This works best in neutral to slightly bullish markets.

Buy stocks when you expect strong price growth. This strategy works well when you have conviction about a company’s future prospects. You benefit from any upward price movement.

Put selling generates income in sideways markets. You keep the premium if the stock stays above your strike price. This provides cash flow from your portfolio.

Stock buying suits long-term investors. You participate in company growth and potential dividend payments. Your assets can compound over many years.

Evaluating Outcomes and Strategies

Both selling puts and buying stocks offer different paths to profit, with unique risk profiles and capital needs. The choice between these strategies depends on your income goals, available cash, and market outlook.

Profit and Loss Potential

When you sell puts, your maximum profit equals the premium you collect. This profit is limited but realized upfront. Your maximum loss occurs if the stock drops to zero, minus the premium received.

Buying stocks offers unlimited profit potential as share prices can rise indefinitely. However, you face the full purchase price as potential loss if the stock becomes worthless.

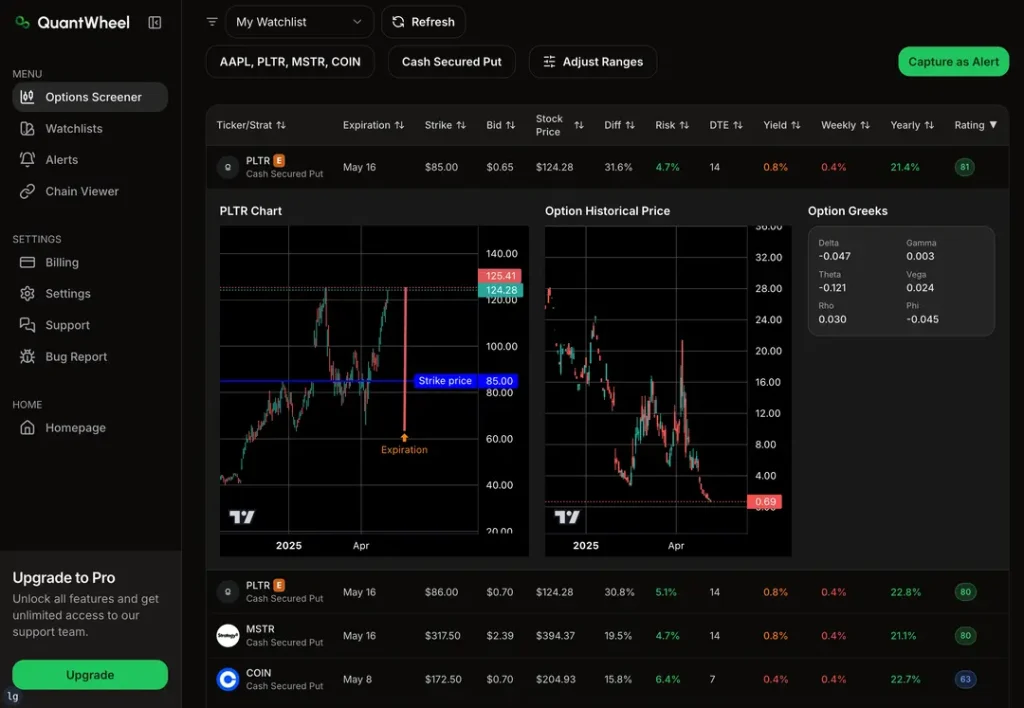

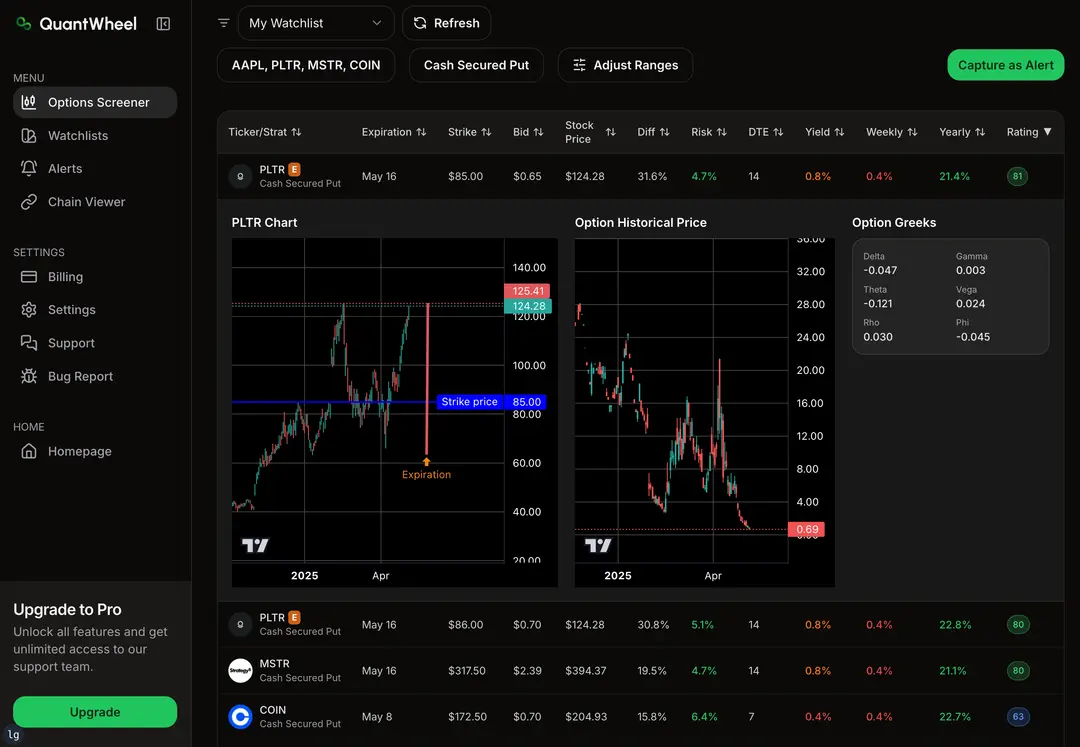

Put selling profit example: You sell a $50 put for $2 premium. Your maximum gain is $200 per contract regardless of how high the stock rises.

Stock buying profit example: You buy 100 shares at $50. If the stock reaches $70, you gain $2,000 compared to the put seller’s $200 maximum.

The risk-reward profiles differ significantly. Put selling provides higher win rates but limited upside. Stock ownership offers unlimited growth potential but higher volatility.

Income Generation and Yield

Selling puts creates immediate income through premium collection. This income is yours to keep regardless of the stock’s movement. Put sellers can generate monthly or weekly cash flow by repeatedly selling new contracts.

Typical put premiums range from 1-5% of the stock price for monthly contracts. This translates to potential annualized yields of 12-60% if repeated consistently.

Stock ownership generates income primarily through dividends. Average dividend yields range from 1-4% annually for most stocks. Some high-dividend stocks yield 5-8%, but these often carry higher risks.

Income comparison:

- Put selling: Immediate cash, repeatable strategy

- Stock ownership: Quarterly dividends, long-term focus

Put income is taxed as short-term capital gains at higher ordinary income rates. Qualified dividends receive preferential tax treatment at lower capital gains rates.

Capital Requirements and Margin

Selling puts requires significant cash or margin capacity. You must secure the full stock purchase price as collateral. For a $50 stock, you need $5,000 in buying power per contract.

Cash-secured puts tie up large amounts of capital for relatively small premium income. Margin accounts allow leverage but increase risk exposure through borrowing costs and margin calls.

Buying stocks requires only the purchase price upfront. You can buy fractional shares with limited capital. A $1,000 investment can purchase partial positions in expensive stocks.

Margin requirements:

- Put selling: 20% of stock value plus premium

- Stock buying: 50% on margin accounts

Leverage amplifies both gains and losses. Put sellers using margin face interest costs that reduce net income. Stock buyers on margin pay borrowing fees that impact returns.

Suitability and Portfolio Impacts

Put selling suits investors seeking income with moderate risk tolerance. This strategy works best in sideways or slowly declining markets. You should only sell puts on stocks you want to own at the strike price.

Stock ownership fits long-term wealth building goals. This approach benefits from compound growth over time. Stocks perform well during extended bull markets and economic expansion.

Market condition preferences:

- Put selling: Neutral to slightly bullish markets

- Stock buying: Strongly bullish long-term trends

Put selling can serve as a stock entry strategy at desired prices below current market value. If assigned, you own shares at an effective cost basis reduced by the premium received.

Both strategies require ongoing monitoring and active management decisions. Put sellers must roll or close positions before expiration. Stock owners need periodic portfolio rebalancing and position sizing adjustments.